Home Equity

-

Home Equity 101: What Every Homeowner Needs to Know

Introduction As a homeowner, understanding the concept of home equity is crucial. Home equity is an important financial tool that can significantly impact your financial wellbeing. In this article, we’ll explore the ins and outs of home equity, how it’s calculated, and the various ways you can leverage it to your advantage. What is Home […]

February 9, 2025 -

How to Pay Off a HELOC Faster

Introduction A Home Equity Line of Credit (HELOC) can be a flexible and convenient way to access funds for various financial needs, from home improvements to debt consolidation. However, like any loan, it’s essential to manage it wisely and aim to pay it off as quickly as possible to minimize interest costs. This guide will […]

February 7, 2025 -

Are student loans considered as debt when getting a HELOC?

Understanding Home Equity Lines of Credit (HELOC) Home Equity Lines of Credit (HELOCs) are a popular financing option for homeowners who want to leverage the equity in their homes. HELOCs provide a flexible line of credit that can be used for various purposes, such as home improvements, debt consolidation, or other major expenses. However, when […]

February 7, 2025 -

Can my house be used as collateral for multiple loans?

Using your house as collateral for a loan can be a powerful financial strategy, providing access to significant funds for various purposes. But what happens if you need to secure multiple loans? Can your house be used as collateral more than once? This article explores the feasibility and implications of using your house as collateral […]

February 7, 2025 -

Are HELOCs Transfer and Withdrawal Instant?

Home Equity Lines of Credit (HELOCs) are a popular financial tool for homeowners looking to leverage the equity in their homes. HELOCs provide a flexible line of credit that can be used for various purposes, such as home improvements, debt consolidation, or major purchases. One of the key benefits of a HELOC is the ability […]

February 7, 2025 -

How to Leverage Home Equity for Debt Consolidation: A Simple Guide

Introduction Managing multiple debts can be overwhelming and financially draining. Leveraging home equity for debt consolidation is a smart strategy that can simplify your finances, reduce interest rates, and accelerate your journey to becoming debt-free. In this guide, we’ll explore how to use home equity for debt consolidation, the benefits and risks, and practical steps […]

February 9, 2025 -

Do You Lose Home Equity When You Refinance?

Refinancing your mortgage can be a strategic move to secure better loan terms, reduce monthly payments, or access home equity. However, it’s natural to wonder whether refinancing might impact the equity you’ve built in your home. This comprehensive guide will provide accurate information, practical tips, and a clear understanding of how refinancing affects home equity, […]

February 6, 2025 -

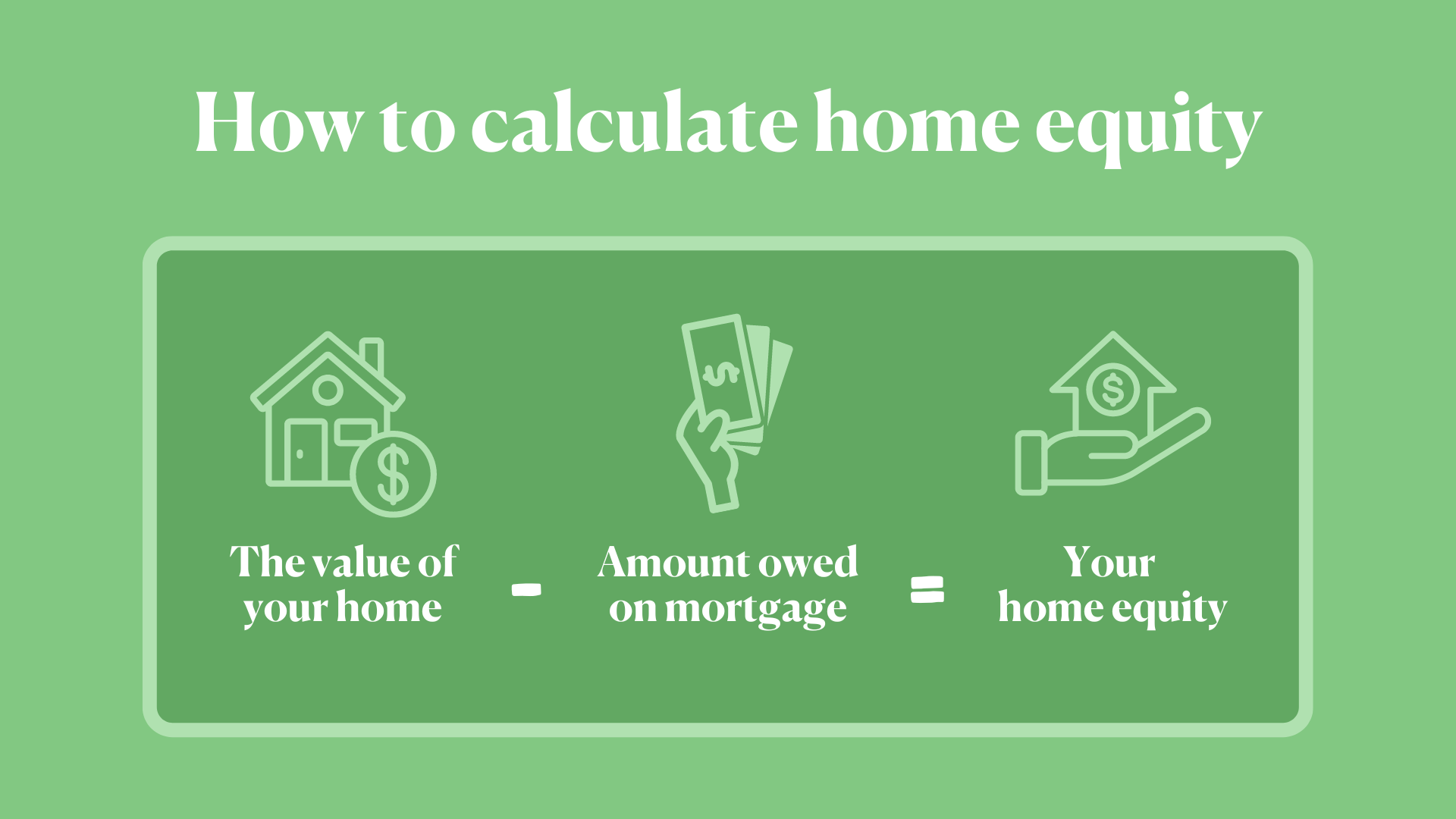

How to Calculate Your Home Equity: A Step-by-Step Guide

Introduction Understanding your home equity is essential for making informed financial decisions. Home equity represents the portion of your property that you truly own, and it can be a valuable asset for funding various expenses, from home improvements to debt consolidation. In this comprehensive guide, we’ll walk you through the process of calculating your home […]

February 9, 2025 -

HELOC vs. 401(k) loan: How to choose

Understanding HELOCs and 401(k) Loans When it comes to borrowing money, two popular options are Home Equity Lines of Credit (HELOCs) and 401(k) loans. Both have their pros and cons, and the best choice depends on your financial situation and goals. Let’s explore the differences between these two options to help you make an informed […]

February 7, 2025 -

If I refi my home, can I keep my HELOC?

Understanding HELOCs and Refinancing Home Equity Lines of Credit (HELOCs) provide homeowners with a flexible line of credit based on the equity in their homes. This credit can be used for various purposes such as home improvements, debt consolidation, or other major expenses. Refinancing your home, on the other hand, involves replacing your existing mortgage […]

February 7, 2025

- « Previous

- 1

- 2

- 3

- 4

- Next »